Accounts Receivable Financing

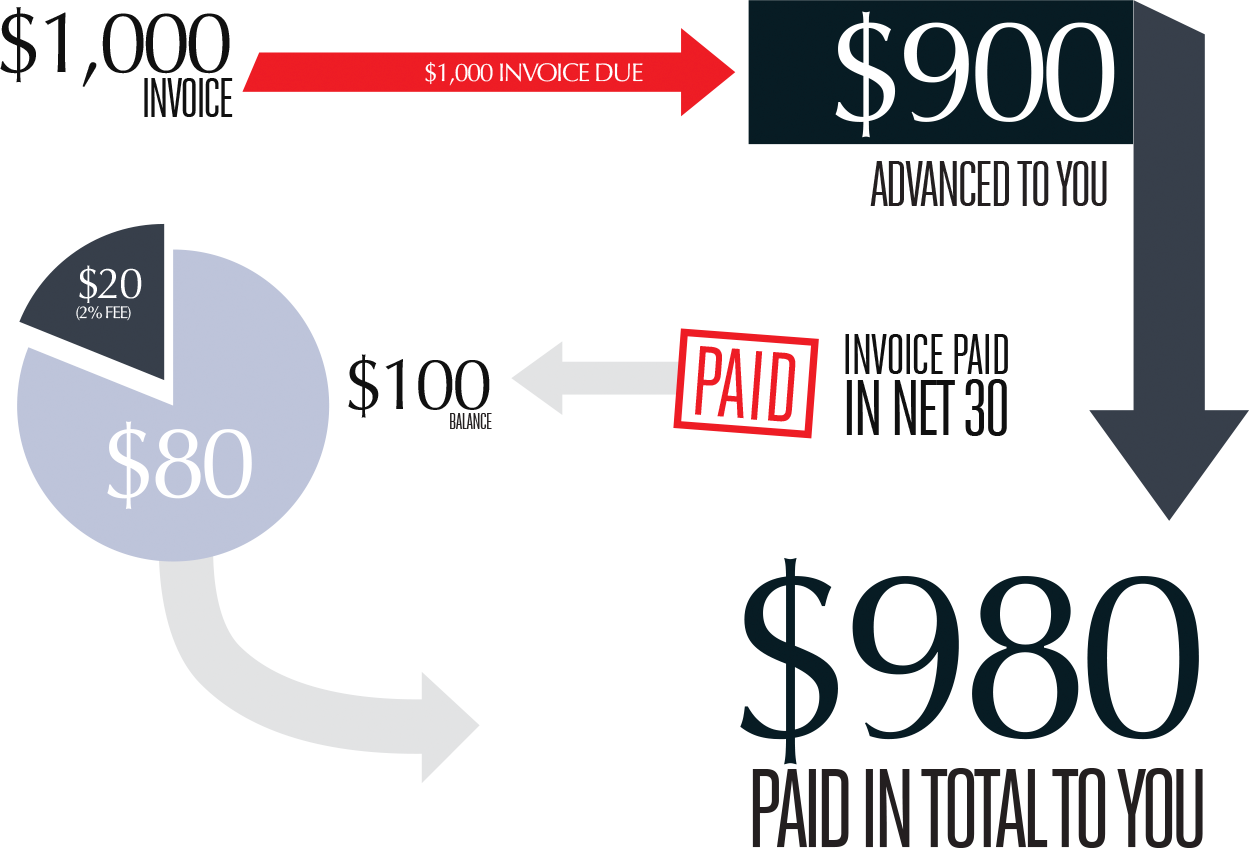

Oftentimes in as little as one day, Centurion advances up to 99% of receivables with fees starting as low as 1%.

Oftentimes in as little as one day, Centurion advances up to 99% of receivables with fees starting as low as 1%.

But how does it work? What exactly is accounts receivable financing?

Also known as factoring, accounts receivable (A/R) financing is the financing of your business-to-business invoices. It has often proven to be the smartest solution for the cash flow challenges that many businesses face.

Quick and Easy: Upon application completion and the submission of necessary, requested backup items, we submit a quote within an hour or less and provide the funding of your invoices in four hours or less.

Accurate and Reliable: While we get to work on receivables management, you can get back to business and save on overhead costs. An account executive, who is personally assigned to you, will send out statements and handle all details of your account.

Future Debt Prevention: We provide monthly credit checks on your customers to ensure they remain dependable revenue streams.

Funding of Receivables: We have extensive experience in providing vital funding for both small and large businesses in almost every industry.

An Alternative to Loans: Providing the best alternative to a line of credit, you can be empowered to grow your business while avoiding the burdens of audits, bank transaction fees, financial covenants and third-party financial managers mandating your business decisions.

Customized Relationships: We will work with you to develop the best plan of action. How should your invoices be sent out, how should we handle your collections, how often do you want statements? You tell us and we can devise the best solution for your specific needs.

Applications are processed and the invoice funding process begins immediately. Once approved, most can receive a closing agreement in just 24 hours or less.